The crypto market is entering a thrilling phase as historical bull cycle patterns appear to be unfolding once again, with Bitcoin and Ethereum leading the charge toward fresh highs.

In this climate, seasoned investors and newcomers alike are zeroing in on the best cryptos to buy now, eyeing altcoins that could deliver outsized gains during the next wave of market enthusiasm.

With institutional money flowing into top assets and retail investors preparing to jump back in, the stage is set for a surge in both established blue-chip altcoins and promising emerging projects.

Ethereum Whale Accumulation Signals Altcoin Rally – Google AI Reveals Top Cryptos to Buy Now

Cryptocurrencies staged a solid rally following yesterday’s strong session, driven by Ethereum surpassing $4,000 for the first time in 2025 and upbeat developments. Large holders are rapidly accumulating $ETH, reflecting strong confidence in its long-term potential amid shifting market conditions.

BitMEX co-founder Arthur Hayes recently added 1,750 $ETH to his portfolio in the past 48 hours, bringing his total Ethereum holdings to roughly $8.53 million, alongside substantial positions in major DeFi tokens.

On-chain data from Lookonchain also reveals that a major, unidentified institution acquired another 49,533 $ETH ($212M). Over the past week, this entity has accumulated 221,166 $ETH ($946.6M) from platforms including FalconX, Galaxy Digital, and BitGo.

Such large-scale purchases highlight sustained buying pressure that could shape $ETH’s price outlook and overall market sentiment. Such aggressive whale activity may indicate preparations for an upcoming altcoin rally, leaving investors asking which crypto to buy now.

Below are some of the top cryptos to buy now, identified by Google AI and highlighted by crypto analyst ClayBro in his video below and also available on his YouTube channel.

Ethereum (ETH)

The first crypto on the list is none other than Ethereum, which is holding above the crucial $4,100 level, signaling market strength and maintaining a bullish trend. Staying above this support is seen as a positive indicator for a continued push higher, with the next key resistance at $4,400 and followed by $4,600.

While short-term pullbacks are possible, these are considered healthy within the broader uptrend, and a retest of $4,100 could solidify it as support. Technical patterns point to the possibility of reaching higher targets, potentially up to $8,000 in the long term, though near-term consolidation remains likely.

The trend remains intact unless Ethereum breaks significantly below support levels, with $4,176 and $3,900 as notable zones to watch. Overall, momentum continues to favor the bulls, keeping the outlook positive for further gains.

Solana (SOL)

Solana has experienced strong upward momentum following the recent announcement that U.S. 401(k) retirement accounts can now include cryptocurrency investments.

This news, combined with favorable market sentiment, helped push Solana’s price toward the $175 target and into the $185–$190 resistance zone. While the current rally suggests short-term bullishness, the key question is whether $SOLcan break above the $190 level and aim for the next target at $220.

The most likely scenario in the near term is a rejection from the $185–$190 range, potentially leading to a pullback toward $175 or $170.

Snorter Token (SNORT)

Snorter Token is a Solana-based meme crypto trading bot currently in its presale phase, raising $2.9 million out of a $3.3 million hard cap.

Designed to outperform established Telegram trading bots, it offers the lowest fees on Solana, lightning-fast sniping, live tracking of new Solana pairs, limit orders, honeypot and rug-pull detection, copy trading, and its exclusive “Snortability” feature for identifying high-potential tokens in a noisy market.

Built for speed and security, it includes front-running and MEV protection, automated sniping, fast secure swaps, and a dashboard for managing trades efficiently. The project plans to go multi-chain, expanding to Ethereum Virtual Machine (EVM) networks like Ethereum, BNB Chain, and Base.

Its roadmap includes stages for development, presale and marketing, multi-chain integration, and further bot expansion with added features such as DeFi partnerships, governance, and algorithmic trading.

The $SNORT token serves as the bot’s utility token, with a total supply of 500 million, allocated across product development, marketing, liquidity, community rewards, airdrops, treasury, and staking rewards.

Inspired by the aardvark’s persistence, the bot is designed to “sniff out” rare market opportunities while filtering out scams and low-quality tokens. With all major competitor features matched or exceeded, Snorter Token aims to become one of the most widely used crypto trading bots in the market.

Its strong utility, solid tokenomics, and growth plans position it as one of the best cryptos to buy for traders seeking efficiency, security, and high upside potential. To take part in the $SNORT token presale, visit snortertoken.com.

XRP (XRP)

XRP is currently trading near its upper micro support at $3.13, a critical level for maintaining its short-term bullish outlook. Holding above this threshold could pave the way for a rebound, while a break below may open the door to a deeper correction.

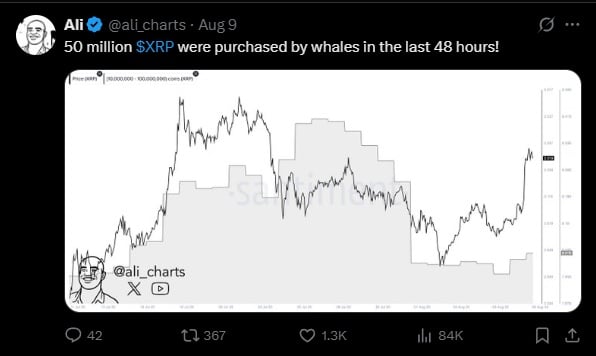

The primary resistance stands at $3.40, a historically significant barrier that must be cleared to aim for higher targets at $3.80 and $4.30. Recent whale accumulation and market structure indicate the potential for an upside move, though momentum remains somewhat constrained.

Source – Ali Martinez via X

Should $3.13 fail to hold, $XRP could revisit supports at $2.85, with further declines possibly extending to the $2.46–$2.21 range before any recovery attempt.

For bullish momentum to resume, buyers need to defend current levels and push above $3.28, which would signal a potential local bottom and increase the chances of another upward leg in the price action.

Chainlink (LINK)

Chainlink has been consolidating since reaching the key resistance level of $23, showing limited movement in recent sessions. The price remains supported between $19.03 and $20.85, and holding above this range could pave the way for another move higher.

However, a break below this support could open the door to a deeper retracement toward the $12.76–$17.13 area. While the test of $23 highlights strong resistance, short-term price action remains uncertain, making immediate predictions less reliable.

A modest pullback appears to have started, but if support levels hold, a rebound is still possible. Similar trends are being observed across multiple altcoins, suggesting that broader market sentiment could play a role in LINK’s next direction.

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.